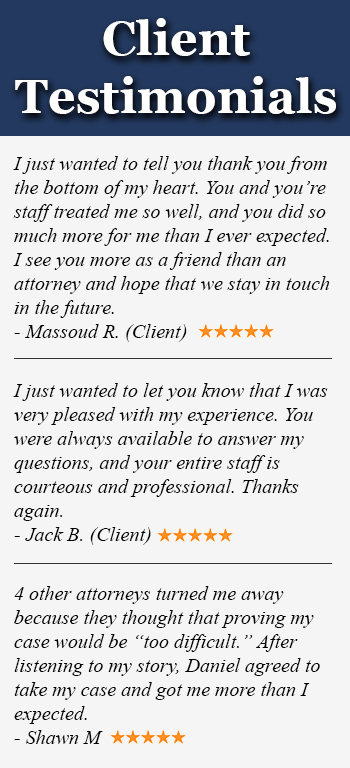

Erie Insurance Group is a provider of auto, business, home, and life insurance coverage based in Erie, Pennsylvania. The company operates through a network of independent agents, who pride themselves on creating a personal connection with their customers. It’s a comforting thought for accident victims who have been injured by someone else’s negligence. Unfortunately, Erie is the same as any other insurance company when it comes to profits, meaning they will look for ways to deny your claim or lowball your settlement as much as possible.

One area they will try to cheat you on is lost wages, which is the amount of job-related income that you were forced to give up due to the injuries from your accident. In this article, we will answer an important question that we frequently receive from injury victims:

Does Erie Insurance have pay for your lost wages if I miss work after an accident?

We know how stressful it can be when you are unable to access the benefits you’re entitled to. Our lawyers are ready to fight for you and take the complexities of an insurance claim off your shoulders. Contact our law firm and speak to one of our experts as soon as possible.

Our Recent Verdicts and Settlements

$1.5 Million

$1.1 Million

$1.5 Million

$600,000

$1.5 Million

$734,851

What Documentation do I have to Show to get Lost Wages Compensation from Erie Insurance?

Obviously, Erie will not take your word for it that you have missed time off at work. You will need to prove your case for lost wages, which can be done with a variety of documents, including:

- Medical records

- Pay stubs or a proof of income letter from your workplace

- Statements from bank accounts

- Tax forms like W2s

- Income tax returns

If you were seriously injured, you may suffer long terms health effects that can force you to work part time or find a new career. Depending on your age, education, and skill level, it may be difficult for you to find work altogether, which can entitle you to future lost wages or lost earning potential. You should get help from an attorney if you are in this situation, as you will most likely need testimony from medical and financial experts. Our lawyers work hand in hand with these professionals in order to maximize payments for injury victims. To learn how we can assist you, call us to schedule a free case review.

I’m Self-Employed. Can I be Reimbursed for Lost Wages?

Yes, even if you don’t earn a set rate of salary, you can ask to be reimbursed for any income you’ve lost as an independent contractor or business owner. Clearly, the amount you are owed can be a bit tricky to calculate, but we’ve worked with many self-employed individuals throughout the years and know what kind of evidence is required in these cases. The following documents are a good place to start:

- Bank statements

- Payment app transactions (PayPal and Cash App, for example)

- Paid invoices

- 1099s

- Tax returns

- Proof of cancelled work or jobs you had to turn down due to your injuries

Available evidence can vary significantly from case to case due to the unique circumstances that apply to self-employed workers. Our attorneys can help you if you’re uncertain as to how to prove a case for lost income.

What if I Used Sick and Vacation Days? Can I be Reimbursed for Paid Time Off?

PTO is a great work-related benefit that’s available through many employers. Usually, these come in the form of sick and vacation days, though some employers offer additional time, like mental health days and floating holidays. It’s logical that you would dip into these benefits to avoid financial hardship while you are recovering from your injuries.

You are entitled to reimbursement for PTO that you were forced to use while recovering from an accident caused by another individual or entity. Sadly, this is where a lot of people face resistance from insurance companies. An insurance adjuster may try to convince you that you haven’t lost any income, since PTO is paid for by your employer. Some agents go so far as to accuse clients of “double-dipping” by seeking reimbursement for used sick or vacations days. This is not the case, however, when you’ve been injured through no fault of your own. When another party is responsible for your accident, they are forcing you to rely on any and all available resources to cover your expenses. Clearly, these resources include paid time off, which you can demand to be paid for through a personal injury claim with Erie Insurance.

Why is Erie Insurance Refusing to Pay for my Lost Wages?

You’ve taken all the right steps to prove your case, yet Erie has still refused your claim for lost wages. It’s undeniably frustrating, but as accident injury lawyers, a claim denial doesn’t surprise us. In fact, this is precisely why we’re here – to ensure that you are not cheated out of the payment you deserve. Even if there is a valid reason as to why your claim was unsuccessful, we can help you gather the necessary evidence and ensure a successful outcome.

At the end of the day, Erie is a profit-based company that looks for ways to hold on to their money. Lowballing your settlement or not paying you at all is the best way to accomplish this goal, though you are not at the mercy of an insurance company that’s acting in bad faith. This brings up another question that clients typically ask us:

Can I sue Erie Insurance for refusing to pay for my lost wages? What are my rights?

If it’s clear that the company had unjustly denied your claim or is using manipulation tactics to pressure you into a low settlement, then yes, you may have grounds to sue Erie Insurance for insurance bad faith. As for what counts as an act of bad faith by an insurance company, here are some examples:

- Failing to wrap up an accident investigation within a reasonable time frame.

- Denying you lost wages or any other compensation without legal justification.

- Mispresenting the terms of an insurance policy (coverage limits, for example).

- Threatening legal action to intimidate the client and get them to sign on a low offer.

- Consistently refusing to make a fair offer when the client has solid evidence to support their compensation request.

Even if you have the right to sue, there may be easier ways to resolve these issues, which our attorneys are happy to discuss with you. Our goal is to settle your claim as fast as possible, and with that in mind, a lawsuit is always the last resort. But if Erie continues to violate your legal rights, we will not hesitate to file a bad faith insurance lawsuit and fight for every penny of the damages you deserve.

Schedule a Free Second Opinion

It’s quite common for people to seek out another attorney, even if they have a lawyer that’s handling their accident claim. Some of these people want to confirm that their case is on the right track, or that the advice from their attorney is correct. But others have serious issues with their attorneys, which must be addressed right away. For example, an attorney that’s inexperienced in the complexities of your accident can cause you to lose your case or have it sit on standby while you struggle to make ends meet.

No matter where you are in the claims process, a second opinion at our office can provide valuable insight on important issues, such as:

- How long do I have to file a lawsuit (statute of limitations)?

- What is the value of my accident claim with Erie Insurance?

- How long will it take to get paid on my case?

This consultation is 100% free with no obligation to switch your lawyer, as it may be in your best interest to stay with your current firm. But there’s no harm in meeting with us and taking advantage of the many years of experience we have in personal injury law. To schedule your free second opinion, please give us a call as soon as you can.

Contact Normandie Law Firm

There are many benefits to having a lawyer when you are in need of compensation for an accident. Primarily, you need someone who’s looking out for your interests as you go head to head with an insurance company. There’s no denying that claimants with representation win higher settlements than those who try to navigate the legal process on their own.

On the other hand, money is tight when you’re dealing with the costs of recuperating from your injuries. At Normandie Law Firm, we believe in free legal services for accident victims. You pay us nothing under the Zero fee guarantee, since we bill the defendant for all our expenses. In addition, we don’t make a penny unless you do, so the only way we get paid is if you get paid. If you’re interested in speaking with our attorneys, contact us to schedule a free case evaluation.

Other Pages on Our Website Related to This Topic

Can I get Lost Wages from AAA – The Auto Club after an Accident

Will State Farm Reimburse me for Lost Wages after an Accident

Will Kemper Reimburse me for Lost Wages after an Accident